Python Loan Calculator

A Python tool that simulates loan payoff strategies to identify the fastest and most cost‑efficient path to becoming debt‑free.

Overview

Managing multiple loans with different balances and interest rates made it difficult to determine the most cost‑effective payoff strategy. Manually iterating scenarios in Excel was slow and error‑prone, so I built a Python‑based optimization tool that simulates payoff strategies, compares interest and duration outcomes, and exports results for analysis.

Problem

Questions like “Which loan should I pay first?” or “How much faster can I finish if I increase my payment?” required repetitive manual calculations. I needed an automated, scalable way to evaluate strategies and understand trade‑offs.

Solution

I developed a loan modeling engine that:

- Ingests loan data (balance, rate, minimum payment)

- Iterates through weighted payoff strategies (interest‑priority, cost‑priority, payment‑priority)

- Simulates different monthly payment amounts

- Calculates total interest, total payments, and months to payoff

- Exports amortization tables and comparison results to CSV This produced a complete payoff landscape showing optimal strategies and diminishing‑return thresholds.

Impact

- Identified the most cost‑efficient payoff order

- Quantified how increased monthly payments reduce payoff time

- Eliminated hours of manual Excel work

- Created a reusable tool for long‑term financial planning

Gallery

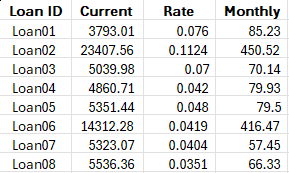

Example loan detail input into the code

Example loan detail input into the code

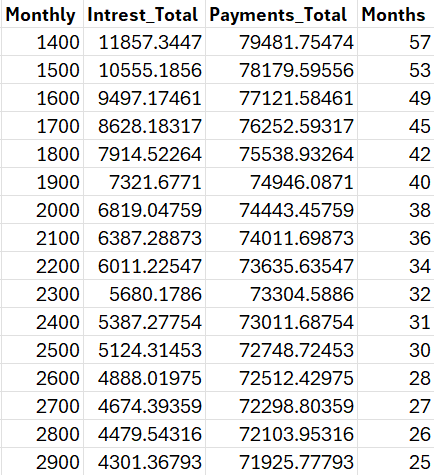

Example monthly budget vs months to complete iteration output

Example monthly budget vs months to complete iteration output

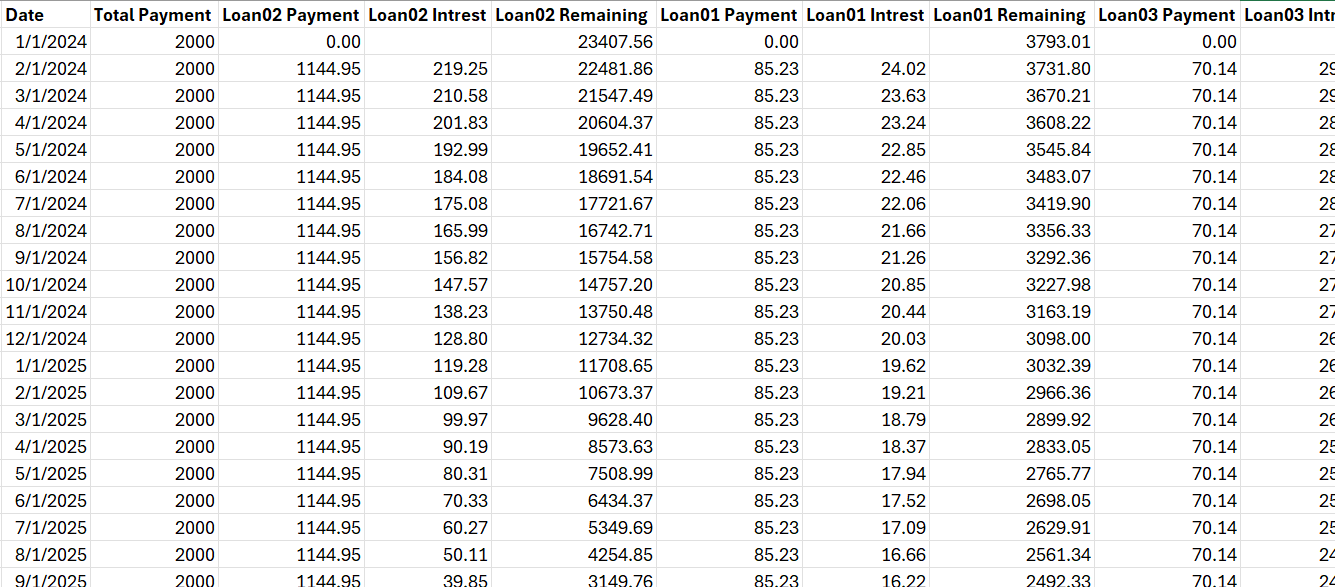

Example amortization table output (continues to the left and down)

Example amortization table output (continues to the left and down)

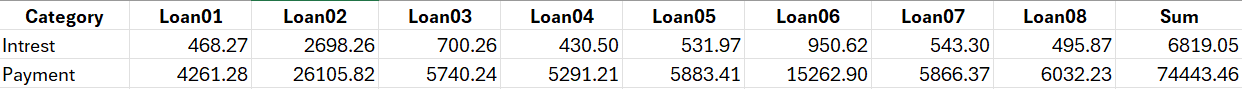

Example totals by loan output

Example totals by loan output

Code Repository

Source code available on GitHub: https://github.com/jdwasner/Loan_Calculator

Future Improvements

- Add visualizations (interest curves, payoff timelines, strategy comparisons)

- Build a simple UI or web app for non‑technical users

- Package as a CLI tool or Python module